So, you’ve heard that Mecklenburg County will be conducting a Countywide revaluation next year, but you’re not entirely sure what that means. Or, maybe you think you know what it means, but just need more information.

The Mecklenburg County Assessor’s Office has you covered. They’ve been dotting their i’s and crossing their t’s and making their rounds to ensure the smoothest revaluation process ever.

They have also provided some helpful FAQ’s below.

- First of all, what does “revaluation” mean?

Revaluation is a process in which all property within a taxing jurisdiction (in this case, Mecklenburg County) is revalued to its current market value by a certain date. So, we’re essentially determining the taxable value of your property. According to state statute, this must happen at least every eight years. Keep in mind, tax rates have no impact on the valuation process. - How does Mecklenburg County prepare for revaluation?

Staff from the County Assessor’s Office are currently visiting taxable properties to make sure the County has the most up-to-date info about each one. If you’re home while staff is conducting their site visit, you’ll most likely receive a knock on your door and someone may ask about some of the characteristics of your home (such as room count). Please note: staff will NOT enter your home. If you’re not home, they’ll leave a door hanger asking for the info they need. - What do the assessors do with the information they collect on my home?

Any of the information our team notes about your property will be entered into our Computer Assisted Mass Appraisal System or CAMA. Property information will be made available to residents online through a tool called Modria. You can use the site to look up your property, update your information and submit inquiries. Our staff walks you through the tool step-by-step in this video! - What if I have questions about revaluation?

Revaluation is a lengthy process, and lots of property owners have questions about what to expect. It’s hard to break down the specifics for you here, because the revaluation will have different impacts from one neighborhood to the next (and even one property to the next)! We can tell you this: The Assessor’s Office has been spending a lot of time on the road visiting neighborhoods throughout the County to inform as many people as they can and answer questions. If you want someone from their office to visit YOUR next meeting, the request form is only a click away! - When will I receive my new tax bill?

Before we send tax bills, each property owner will receive a new revaluation notice in January 2019 that provides their new property valuation effective Jan. 1. Tax bills will be mailed in July 2019. Once you receive your value, if you believe our assessors missed the mark (meaning, we significantly undervalued or overvalued your property), you can file an appeal with the Assessor’s Office within 30 days of the notice date. You may file your appeal online, by mail, by phone or in person.

So that’s the long and short of it! Our goal is to make the 2019 Revaluation process as smooth and transparent as possible. You can find all of this information (and more) anytime at MeckReval.com, and don’t forget to reach out to the Assessor’s Office if you have questions. You can also reach out to us on Facebook and Twitter.

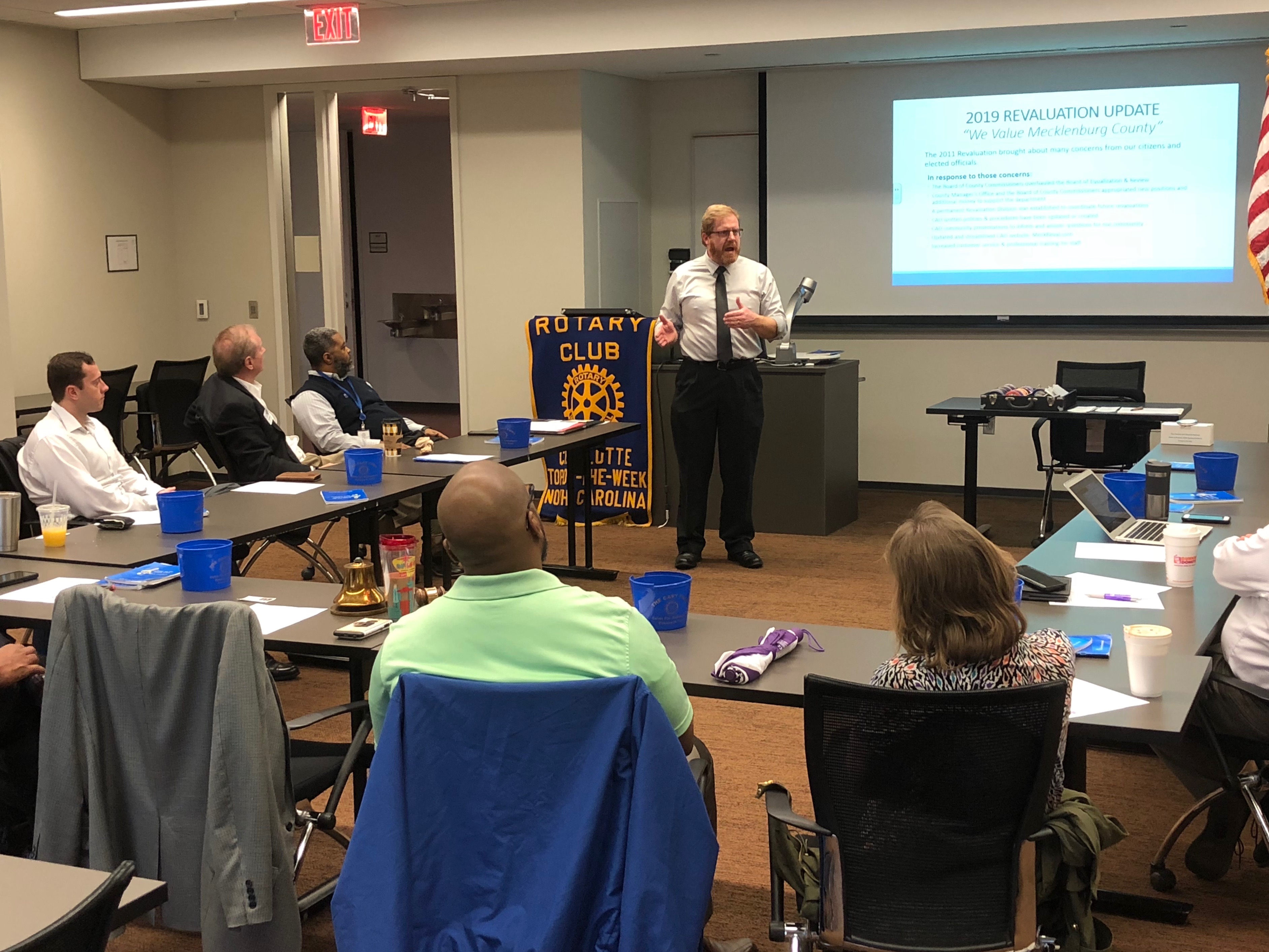

Mecklenburg County Assessor Ken Joyner gives a presentation on the 2019 Revaluation.